Gamechanger Alert! Jio & BlackRock Team Up to Disrupt Mutual Funds Industries

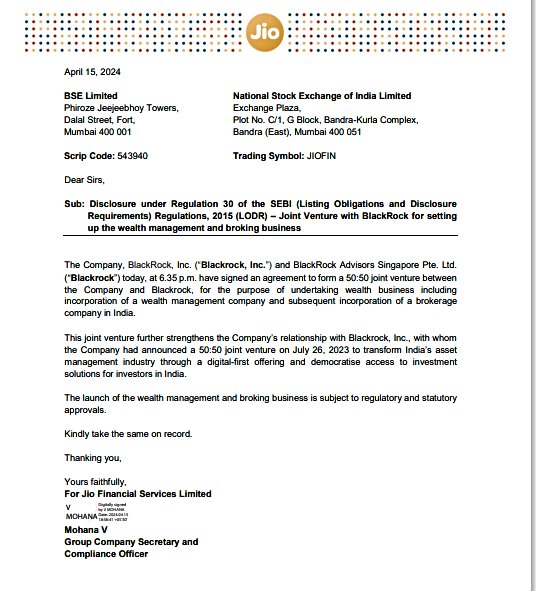

In July 2023, Jio Financial Services, a subsidiary of Reliance Industries, and BlackRock, the world’s largest asset manager, announced a groundbreaking joint venture (JV) poised to disrupt India’s mutual fund industry. This strategic alliance has the potential to revolutionize how Indians invest and manage their wealth.

Table of Contents

The Powerhouse Partnership

Jio Financial brings its massive customer base and deep understanding of the Indian market to the table. BlackRock, on the other hand, contributes its unparalleled experience in investment management and global reach. This synergy is expected to create a powerful force in the Indian mutual fund landscape.

Also Discover Best Zero Brokerage Trading Apps that save 1000 Cr Brokerage of Indian

Democratizing Investments for Every Indian

A core objective of the JV is to make investment solutions more accessible to the Indian public. Jio Financial’s extensive digital reach can play a crucial role in attracting new investors, particularly those who haven’t traditionally participated in the mutual fund market. By leveraging BlackRock’s expertise in creating user-friendly investment products, the JV aims to simplify investing and cater to a broader range of risk appetites.

What to Expect: A Look into the Future

While the Jio Financial BlackRock Mutual Fund awaits regulatory approval from SEBI (Securities and Exchange Board of India), here’s a glimpse of what we might see:

- Digital-First Approach: The mutual fund platform is expected to be heavily reliant on technology, offering a seamless online experience for investors. This caters to the growing trend of online mutual fund investment in India.

- Diverse Investment Options: A variety of mutual fund schemes catering to different risk profiles and financial goals are likely to be offered. BlackRock’s global perspective could introduce unique investment opportunities for Indian investors, potentially including international mutual funds.

- Competitive Fees: The JV might leverage its economies of scale to offer competitive expense ratios, potentially making mutual fund investing more affordable. This could lead to low-cost mutual funds becoming more prevalent in India.

Current Status (As of April 19, 2024)

It’s important to note that as of today, April 19, 2024, the Jio Financial BlackRock Mutual Fund is not yet available for investment. The application filed with SEBI is still under process.

Looking Ahead: A Disruptive Force on the Horizon

The Jio Financial and BlackRock JV is a significant development for India’s asset management industry. With its focus on digital accessibility, diverse investment options, and potentially competitive fees, this collaboration has the potential to empower a new generation of Indian investors. While the launch date remains uncertain, this partnership is definitely one to watch out for in the realm of mutual fund news and developments.

The announcement of a joint venture (JV) between Jio Financial Services and BlackRock to launch a mutual fund platform in India sent ripples through the financial world. While the fund itself awaits regulatory approval and isn’t available for investment yet (as of April 19, 2024), the news has already impacted Jio Financial’s stock price.

Positive Impact: Investor Confidence Boost

The market reacted positively to the Jio-BlackRock partnership. Here’s how it might benefit Jio Financial’s stock:

- Enhanced Credibility: BlackRock’s global reputation as a leading asset manager adds a layer of trust and expertise to Jio Financial’s offerings. This can attract new investors and boost confidence in the company’s future prospects.

- Expansion into Wealth Management: The JV signifies Jio Financial’s foray into the lucrative wealth management space. This diversification can unlock new revenue streams and potentially lead to increased profitability.

- Digital Innovation: BlackRock’s experience can contribute to creating a user-friendly and tech-driven mutual fund platform. This aligns with Jio’s digital-first approach and could attract a wider investor base, particularly younger demographics comfortable with online investing.

News articles reported Jio Financial’s stock price surging 5% after the JV announcement. This initial positive reaction reflects investor optimism about the company’s future. you can also start investing in mutual fund or stock at life time Zero Brokerage on all Segment with Mstock