Best UPI Apps for Business: The Future of Business Payments

UPI (Unified Payments Interface) has revolutionized the digital payments landscape in India, making it easier and more convenient for businesses to accept payments from customers. With so many UPI apps available in the market, it can be difficult to choose the right one for your business.

In this blog post, we will discuss the Best UPI apps for business in India in 2023, based on their features, benefits, and pricing. We will also provide some additional tips for choosing a UPI app for your business

1.PhonePe

PhonePe for Business is a comprehensive digital payment platform that empowers businesses of all sizes to accept payments seamlessly through various channels, including mobile wallets, UPI, and credit/debit cards. It offers a variety of benefits, including increased sales, improved customer satisfaction, reduced costs, and enhanced security.

Benefits of Using PhonePe for Business:

PhonePe for Business offers a variety of benefits to businesses, including:

- Increased sales: By providing multiple payment options, PhonePe for Business opens up new avenues for revenue generation. Customers prefer the convenience of digital payments, and by accommodating their preferences, businesses can increase sales and broaden their customer base.

- Improved customer satisfaction: Customer satisfaction is paramount in any business. PhonePe for Business simplifies the payment process, making it quick and hassle-free. Happy customers are more likely to return and recommend your business to others.

- Reduced costs: Handling cash can be costly and risky. With PhonePe for Business, you reduce the need for physical currency. This not only saves you money on cash handling fees but also enhances security by minimizing the risk of theft or fraud.

- Enhanced security: PhonePe for Business employs advanced fraud detection and prevention technologies to safeguard your transactions. You can rest assured that your business is protected from fraudulent activities, providing peace of mind for both you and your customers.

Features of PhonePe for Business:

PhonePe for Business offers a variety of features to help businesses manage their payments efficiently, including:

- Real-time settlement: When a customer makes a payment, the funds are instantly transferred to your bank account. This rapid settlement ensures you have access to your funds when you need them, eliminating delays associated with traditional payment methods.

- Detailed reporting: Understanding your business’s financial health is crucial. PhonePe for Business provides real-time access to comprehensive reports on your sales and transactions. This data empowers you to make informed decisions and optimize your operations.

- Fraud protection: Security is paramount in the digital payment landscape. PhonePe for Business employs cutting-edge technologies to detect and prevent fraudulent transactions. You can have confidence that your business is protected from potential threats.

- Multiple payment options: Diversity in payment methods is essential to accommodate a broad customer base. PhonePe for Business allows you to accept payments through various channels, including mobile wallets, UPI apps, and credit/debit cards. This flexibility ensures you don’t miss out on any potential sales.

- Easy integration: Integrating PhonePe for Business into your existing systems is a breeze. You don’t need to overhaul your entire infrastructure to leverage the benefits of this platform. It seamlessly integrates with your current setup, ensuring a smooth transition to digital payments.

How to Get Started with PhonePe for Business:

Getting started with PhonePefor Business is a straightforward process. Follow these steps to embark on your digital payment journey:

- Visit the PhonePe for Business website and create an account.

- Complete the verification process.

- Integrate PhonePe for Business into your existing systems.

- Start accepting digital payments from your customers.

PhonePe for Business is the ideal digital payment platform for businesses of all sizes in India. It offers a variety of benefits, features, and easy integration, making it the perfect solution to revolutionize your business payments and provide your customers with a convenient and secure payment experience.

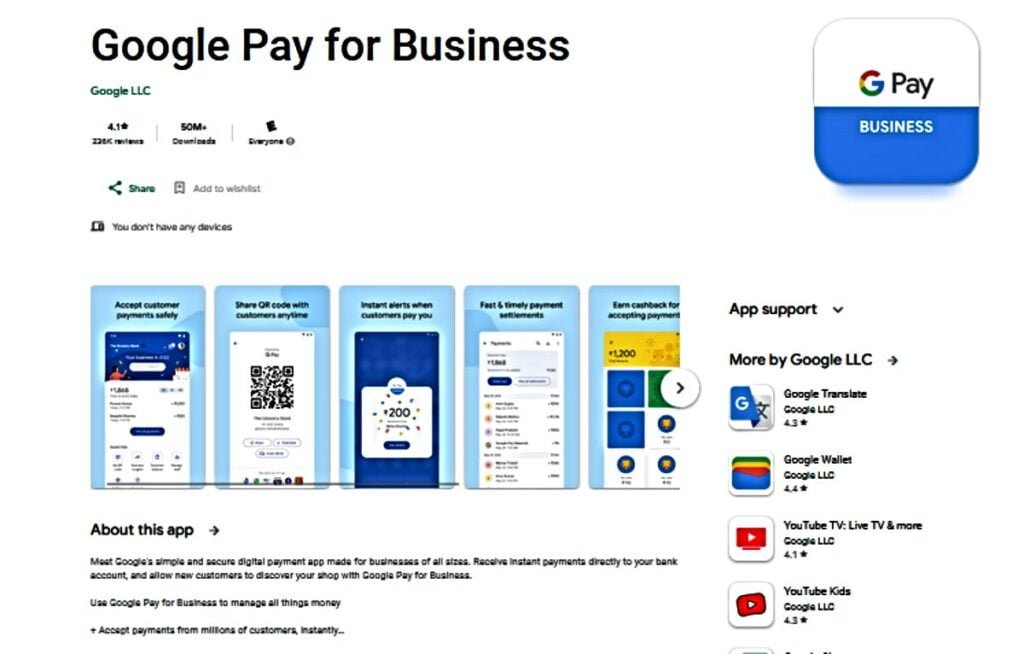

2.Google Pay

What is Google Pay for Business?

Google Pay for Business is a digital payment platform that allows businesses of all sizes to accept payments from customers through a variety of channels, including mobile wallets, UPI, and credit/debit cards. Google Pay for Business also offers a variety of features to help businesses manage their payments more effectively.

Benefits of Using Google Pay for Business

There are many benefits to using Google Pay for Business, including:

- Increased sales: Google Pay for Business allows businesses to accept payments from customers through a variety of channels, which can lead to increased sales.

- Improved customer satisfaction: Google Pay for Business makes it easy for customers to pay for goods and services, which can lead to improved customer satisfaction.

- Reduced costs: Google Pay for Business eliminates the need for businesses to handle cash, which can save businesses money on fees and security costs.

- Improved security: Google Pay for Business uses the latest fraud detection and prevention technologies to protect businesses from fraudulent transactions.

Google Pay for Business: The Complete Guide to Digital Payments

Overview

Google Pay for Business is a digital payment platform that allows businesses of all sizes to accept payments from customers through a variety of channels, including mobile wallets, UPI, and credit/debit cards. It also offers a variety of features to help businesses manage their payments more effectively, such as real-time settlement, detailed reporting, and fraud protection.

Benefits of Using Google Pay for Business

There are many benefits to using Google Pay for Business, including:

- Increased sales: Google Pay for Business allows businesses to accept payments from customers through a variety of channels, which can lead to increased sales.

- Improved customer satisfaction: Google Pay for Business makes it easy for customers to pay for goods and services, which can lead to improved customer satisfaction.

- Reduced costs: Google Pay for Business eliminates the need for businesses to handle cash, which can save businesses money on fees and security costs.

- Improved security: Google Pay for Business uses the latest fraud detection and prevention technologies to protect businesses from fraudulent transactions.

- Real-time settlement: Businesses receive payments in their bank account instantly.

- Detailed reporting: Businesses can track their payments in real-time and get detailed reports on their sales and transactions.

- Fraud protection: Google Pay for Business uses the latest fraud detection and prevention technologies to protect businesses from fraudulent transactions.

- Multiple payment options: Google Pay for Business allows businesses to accept payments from customers through a variety of channels, including mobile wallets, UPI, and credit/debit cards.

- Easy integration: Google Pay for Business can be easily integrated with existing business systems.

How to Get Started with Google Pay for Business

Getting started with Google Pay for Business is easy. Simply visit the Google Pay for Business website and sign up for an account. Once you have signed up, you will be able to start accepting payments from customers instantly.

- Sign up for Google Pay for Business.

- Use the Google Account you’d like to use to accept payments for your business. If you don’t have a Google Account, create one.

Note: If you want to create a Google Account with your existing email address instead of setting up a Gmail account, follow these steps. - Follow the on-screen prompts to enter your business information into the form.

- Enter your Unified Payments Interface ID (UPI ID), also known as a virtual payment address (VPA). If you don’t already have a VPA, create one.

If you are looking for a reliable and secure digital payment platform for your business, then Google Pay for Business is the perfect solution for you.

Sign up for Google Pay for Business today and start accepting digital payments from your customers. It’s quick, easy, and secure!

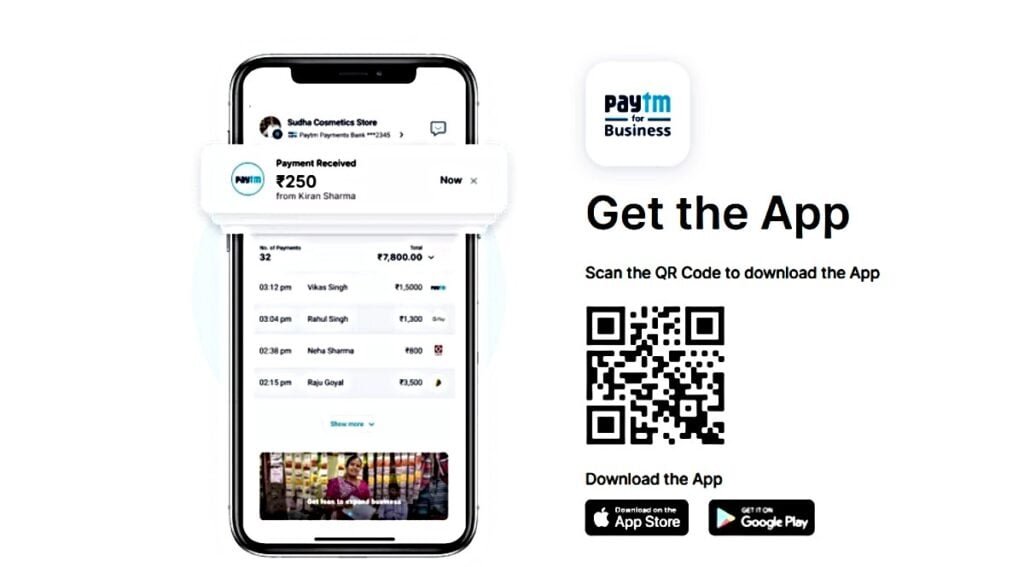

3.Paytm

Paytm for Business is the ultimate digital payment platform for businesses of all sizes in India. With over 27 million merchants registered and over 1 billion transactions processed every month, Paytm for Business is the leading digital payment provider in India. Sign up today and start accepting digital payments from your customers instantly!

Benefits of Using Paytm for Business

There are many benefits to using Paytm for Business, including:

- Increased sales: Paytm for Business allows businesses to accept payments from customers through a variety of channels, which can lead to increased sales.

- Improved customer satisfaction: Paytm for Business makes it easy for customers to pay for goods and services, which can lead to improved customer satisfaction.

- Reduced costs: Paytm for Business eliminates the need for businesses to handle cash, which can save businesses money on fees and security costs.

- Improved security: Paytm for Business uses the latest fraud detection and prevention technologies to protect businesses from fraudulent transactions.

- Real-time settlement: Businesses receive payments in their bank account instantly.

- Detailed reporting: Businesses can track their payments in real-time and get detailed reports on their sales and transactions.

- Fraud protection: Paytm for Business uses the latest fraud detection and prevention technologies to protect businesses from fraudulent transactions.

- Multiple payment options: Paytm for Business allows businesses to accept payments from customers through a variety of channels, including mobile wallets, UPI, and credit/debit cards.

- Easy integration: Paytm for Business can be easily integrated with existing business systems.

Features of Paytm for Business

Paytm for Business offers a variety of features to help businesses manage their payments more effectively, including:

- All-in-one QR code: Businesses can accept payments from all major payment wallets and UPI apps using a single QR code.

- Payment links: Businesses can create and share payment links with customers to accept payments over the phone, email, or social media.

- Online invoicing: Businesses can create and send invoices to customers online and accept payments directly through the invoice.

- Payment gateway: Businesses can integrate Paytm for Business with their website or mobile app to accept payments directly from their customers.

- Business loans: Paytm for Business offers business loans to help businesses grow and expand.

Latest Updates and Features

Here are some of the latest updates and features offered by Paytm for Business:

- Paytm Subscription: Paytm Subscription allows businesses to offer recurring subscriptions to their customers. This is a great way to generate recurring revenue and build long-term relationships with customers.

- Paytm Payouts: Paytm Payouts allows businesses to make instant payouts to their employees, suppliers, and partners. This is a fast and convenient way to manage your finances.

- Paytm Business Insights: Paytm Business Insights provides businesses with detailed reports on their sales and transactions. This data can be used to make informed decisions about your business.

- Paytm Soundbox: Paytm Soundbox is a small device that provides businesses with audio notifications for every transaction they receive. This is a great way to stay on top of your payments without having to constantly check your phone.

Getting Started with Paytm for Business

Getting started with Paytm for Business is easy. Simply visit the Paytm for Business website and sign up for an account. Once you have signed up, you will be able to start accepting payments from customers instantly.

Conclusion

Paytm for Business is a comprehensive digital payment platform that offers a wide range of services to help businesses of all sizes accept and manage digital payments. With Paytm for Business, businesses can benefit from real-time settlement, detailed reporting, fraud protection, and multiple payment options.

If you are looking for a reliable and secure digital payment platform for your business, then Paytm for Business is the perfect solution for you.

Additional Tips for Businesses Using Paytm for Business

- Make sure to promote your Paytm for Business payment options to your customers. You can do this by displaying Paytm QR codes and payment links in your store, on your website, and in your marketing materials.

- Use Paytm for Business’s reporting features to track your sales and transactions. This data can be used to make informed decisions about your business, such as which products are selling well and which payment methods are most popular with your customers.

- Take advantage of Paytm for Business’s security features to protect your business from fraudulent transactions. Paytm for Business uses a variety of fraud detection and prevention technologies to keep your business safe.

- Paytm for Business offers a variety of products and services, including:

- All-in-one QR code

- Payment links

- Online invoicing

- Payment gateway

- Business loans

4. Amazon Pay

Amazon Pay for Business is a one-stop shop for business payments. It offers a variety of features and benefits to help businesses save time, improve efficiency, and control their spending. Sign up for a free account today and start experiencing the benefits of Amazon Pay for Business

Benefits of using Amazon Pay for Business

Amazon Pay for Business offers a number of benefits for businesses of all sizes. These benefits include:

- Centralized purchasing: Amazon Pay for Business allows businesses to make all of their purchases in one place, with a single account. This saves time and simplifies expense management.

- Flexible payment options: Businesses can choose from a variety of payment options, including credit cards, debit cards, and purchase orders. This gives businesses the flexibility to choose the payment option that works best for them.

- Approval workflows: Amazon Pay for Business allows businesses to set up approval workflows for purchases. This helps to ensure that all purchases are compliant with company policies.

- Reporting and analytics: Amazon Pay for Business provides businesses with detailed reports and analytics on their spending. This helps businesses to track their spending and identify areas where they can save money

Benefits of using Amazon Pay for Business

Amazon Pay for Business offers a number of benefits for businesses of all sizes. These benefits include:

- Convenience: Amazon Pay for Business is a convenient and easy-to-use platform. Businesses can make all of their purchases in one place, with a single account.

- Efficiency: Amazon Pay for Business helps businesses to save time and improve efficiency. Businesses can streamline their purchasing process and reduce the amount of time they spend managing invoices and payments.

- Control: Amazon Pay for Business gives businesses control over their spending. Businesses can set up approval workflows and track their spending in detail.

- Security: Amazon Pay for Business is a secure platform. Businesses can be confident that their data is safe and that their payments are processed securely.

How to use Amazon Pay for Business

To use Amazon Pay for Business, businesses need to create an account. Once they have created an account, businesses can start making purchases on Amazon.com. Businesses can also add employees to their accounts and assign them different levels of access.

When businesses make a purchase on Amazon.com using Amazon Pay for Business, they can choose from a variety of payment options, including credit cards, debit cards, and purchase orders. Businesses can also set up approval workflows for purchases.

Amazon Pay for Business provides businesses with detailed reports and analytics on their spending. Businesses can use these reports to track their spending and identify areas where they can save money.

Conclusion:

Amazon Pay for Business is a comprehensive business payment solution that offers a variety of benefits for businesses of all sizes. It is a convenient, efficient, secure, and affordable way to make business purchases.

5.BharatPe

BharatPe is a UPI payment solution that is specifically designed for small businesses. It offers several features that are specifically tailored to the needs of small businesses, such as:

- QR code payments: BharatPe QR code payments are free for businesses.

- Links: BharatPe links are also free for businesses.

- Invoices: BharatPe allows businesses to generate and send invoices to their customers.

- Settlement: BharatPe offers instant settlement for all UPI payments.

BharatPe also offers several other benefits for small businesses, such as:

- Business loans: BharatPe offers business loans to small businesses.

- Financial services: BharatPe offers several financial services to small businesses, such as insurance and accounting.

Conclusion

There are a number of great UPI apps available for businesses in India. The best UPI app for your business will depend on your specific needs and preferences.

If you are looking for a UPI app with a wide range of features and a large user base, then PhonePe or Google Pay would be a good choice. If you are looking for a UPI app that is specifically designed for small businesses, then BharatPe would be a good choice.

Additional tips for choosing Best UPI apps for business

- Customer support: Make sure to choose a UPI app that offers good customer support, especially if you are a small business with limited resources.

- Security: Prioritize a UPI app with a strong reputation for security, safeguarding your business and customer data.

- Pricing: Compare the pricing plans of different UPI apps to choose one that is affordable for your business.

- Features: Consider the features that are important to your business, such as QR code payments, links, invoices, and instant settlement.

- Ease of use: Choose a UPI app that is easy to use for both you and your customers.

- Reputation: Read reviews from other businesses to get their feedback on different UPI apps.

In addition to the above tips, you may also want to consider the following factors when choosing a UPI app for your business:

- Industry: Some UPI apps may be better suited for certain industries than others. For example, if you are in the retail industry, you may want to choose a UPI app that offers loyalty programs or other features that can help you attract and retain customers.

- Business size: If you are a small business, you may want to choose a UPI app that offers free or low-cost pricing plans. If you are a larger business, you may want to choose a UPI app that offers more advanced features, such as batch processing or integration with your accounting software.

- Growth plans: If you are planning to grow your business in the future, you may want to choose a UPI app that has a large user base and offers a wide range of features.