Best Payment App for Teenagers in India 2024

Introduction

As a teenager in India, you may want to have your own money to spend on things like clothes, movies, and video games. But you may not be old enough to have a bank account or credit card. That’s where payment apps come in.

Payment apps are mobile apps that allow you to send and receive money, pay bills, and shop online without having a bank account. They are a great way for teenagers to manage their money and learn about financial responsibility.

5 Best Payment Apps for Teenagers

- Muvin

- FamPay

- Streak

- Xare

- Junio

Download CRED & Get assured cashback Rs 250 on first bill payment

1.Muvin

Muvin is a digital bank for young adults in India. It offers a variety of features, including:

- A prepaid card that can be used for online and offline purchases

- UPI payments [Best UPI Apps in India]

- Money management tools

- Educational resources on financial literacy

Muvin’s prepaid card is issued by RuPay, and it can be used at any merchant that accepts RuPay cards. You can also use your muvin card to withdraw cash from ATMs.

Muvin also offers UPI payments, which means you can send and receive money instantly using your smartphone. UPI payments are convenient and fast, and they can be used to pay for goods and services both online and offline.

Muvin’s money management tools help you track your spending and budget your money. You can also set financial goals and track your progress towards achieving them.

Muvin also offers educational resources on financial literacy. These resources can help you learn about money management, investing, and other financial topics.

Also, Discover The 5 Best UPI Apps For Cashback On Every Transaction

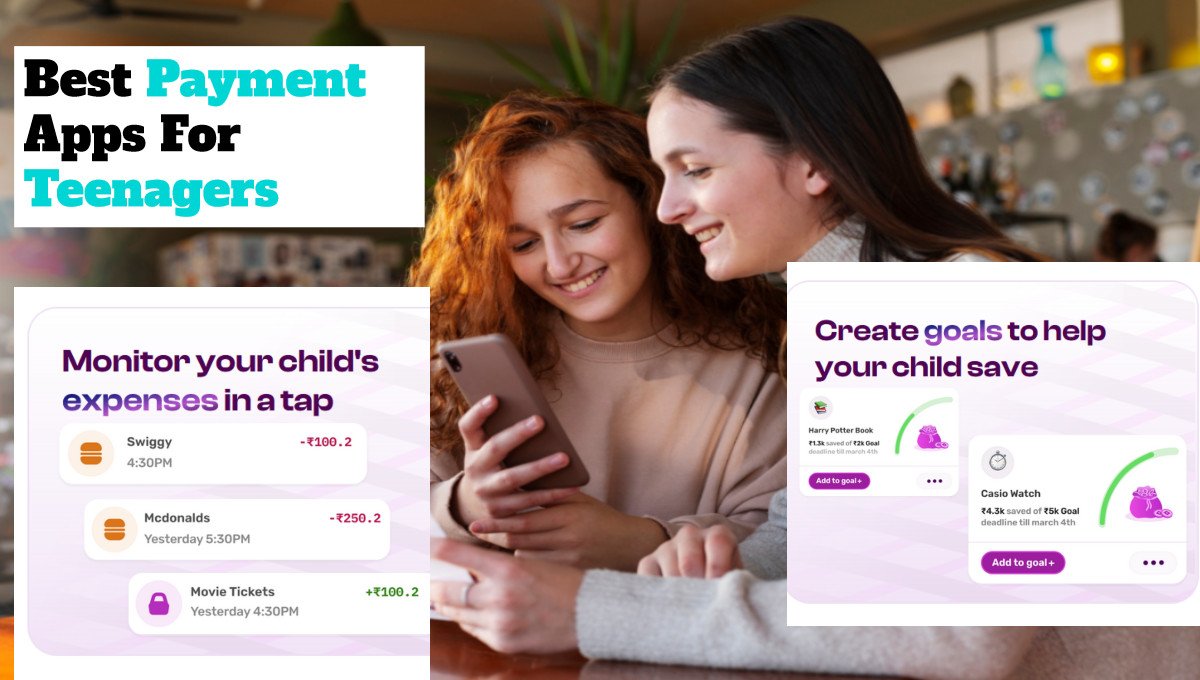

2.FamPay

FamPay is a prepaid card and payment app for teenagers. It offers a variety of features, including:

- A prepaid card that can be used for online and offline purchases

- UPI payments

- Bill payments

- Gift cards

- Parental controls

FamPay’s prepaid card is issued by Visa, and it can be used at any merchant that accepts Visa cards. You can also use your FamPay card to withdraw cash from ATMs.

FamPay also offers UPI payments, which means you can send and receive money instantly using your smartphone. UPI payments are convenient and fast, and they can be used to pay for goods and services both online and offline.

FamPay also allows you to pay bills and purchase gift cards. Additionally, FamPay offers parental controls, so parents can monitor their children’s spending and set spending limits.

Also, Know What is UPI lite and How it Saves Your time On Fuel Station

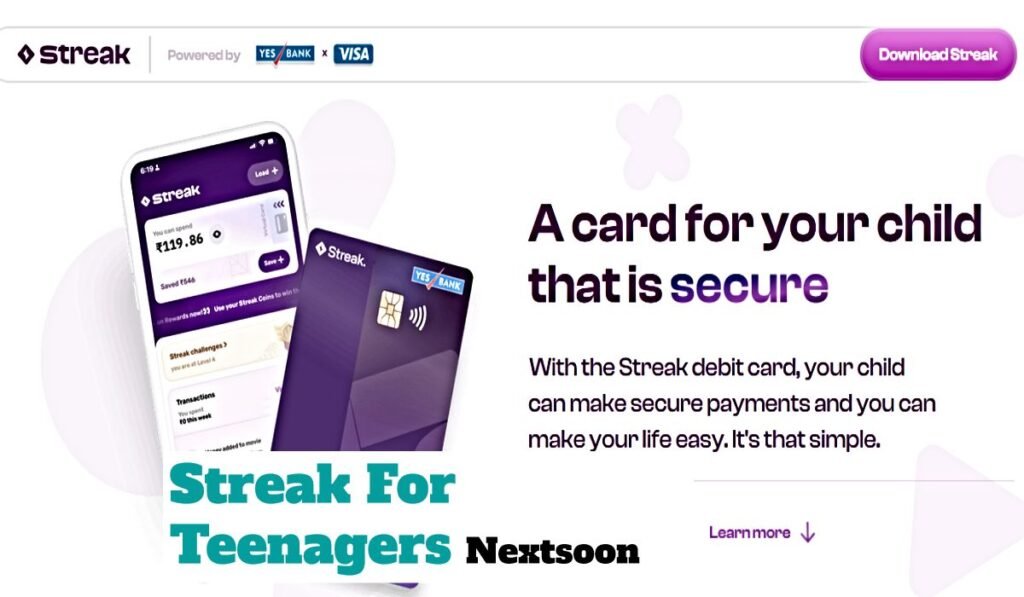

3. Streak-[Powerd by Yesbank ]

Streak is a payment app for teenagers that offers a variety of features, including:

- A prepaid card that can be used for online and offline purchases

- UPI payments

- Bill payments

- Money management tools

- Educational resources on financial literacy

Streak’s prepaid card is issued by Mastercard, and it can be used at any merchant that accepts Mastercard cards. You can also use your Streak card to withdraw cash from ATMs.

Streak also offers UPI payments, which means you can send and receive money instantly using your smartphone. UPI payments are convenient and fast, and they can be used to pay for goods and services both online and offline.

Streak also allows you to pay bills and offers money management tools and educational resources on financial literacy.

Also, Discover the Best UPI Apps for your Business

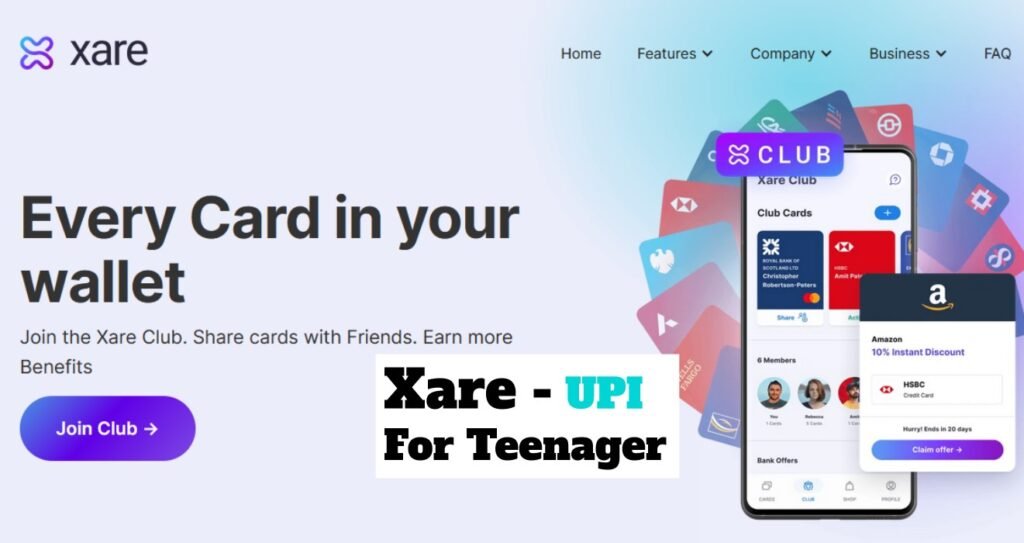

4.Xare

Xare is a payment app for teenagers that offers a variety of features, including:

- A virtual card that can be used for online and offline purchases

- UPI payments

- Bill payments

- Gift cards

- Parental controls

Xare does not offer a physical prepaid card. Instead, it offers a virtual card that can be used for online and offline purchases.

Xare also offers UPI payments, which means you can send and receive money instantly using your smartphone. UPI payments are convenient and fast, and they can be used to pay for goods and services both online and offline.

Xare also allows you to pay bills and purchase gift cards. Additionally, Xare offers parental controls, so parents can monitor their children’s spending and set spending limits.

5. Junio

Junio is a smart card for teenagers that can be used for online and offline purchases. It also offers a variety of other features, including:

- UPI payments

- Bill payments

- Money management tools

- Rewards for good financial behavior

Junio’s smart card is issued by Mastercard, and it can be used at any merchant that accepts Mastercard cards. You can also use your Junio card to withdraw cash from ATMs.

Junio also offers UPI payments, which means you can send and receive money instantly using your smartphone. UPI payments are convenient and fast, and they can be used to pay for goods and services both online and offline.

Junio also allows you to pay bills and offers money management tools. Additionally, Junio offers rewards for good financial behavior.

Here is a well-structured and human-written version of the article on the best payment app for teenagers in India:

Additional Information

To choose the best payment app for teenagers in India you should consider the following points

In addition to the features and considerations listed above, there are a few other things to keep in mind when choosing a payment app for your teenager:

- User interface: The app should be easy to use and navigate.

- Customer support: The app should offer good customer support in case your teenager has any problems.

- Brand reputation: Choose a payment app from a reputable company.

- When choosing a payment app, it is important to consider the following factors:

- Features: What features are important to you? Do you need an app that offers budgeting tools? Parental controls? The ability to make both online and offline payments?

- Security: Choose an app that is secure and has a good reputation.

- Ease of use: The app should be easy to use and navigate.

- Fees: Some payment apps charge fees for certain transactions. Be sure to compare the fees before choosing an app.

It is also important to talk to your teenager about the responsible use of payment apps. Teach them about the importance of budgeting, saving money, and avoiding debt.

Recommended