5 Best UPI Apps For Cashback 2025 [ Updated]

Understand-UPI Apps

UPI apps are mobile applications that allow users to make payments using the Unified Payments Interface (UPI). UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI) that facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions.UPI apps also offer a variety of cashback and rewards programs, which can help you save money on your everyday purchases.

Discover the Best UPI apps for cashback and Reward save money on every transaction Our list of the top UPI apps includes cashback on every payment that you make. In this article, we will discuss the 5 Best UPI apps for cashback. We will also provide tips on how to choose the best UPI app for your needs and how to optimize your cashback earnings.

List of 5 Best UPI apps for cashback in 2025

- Google Pay

- PhonePe

- Paytm

- CRED

- Amazon Pay

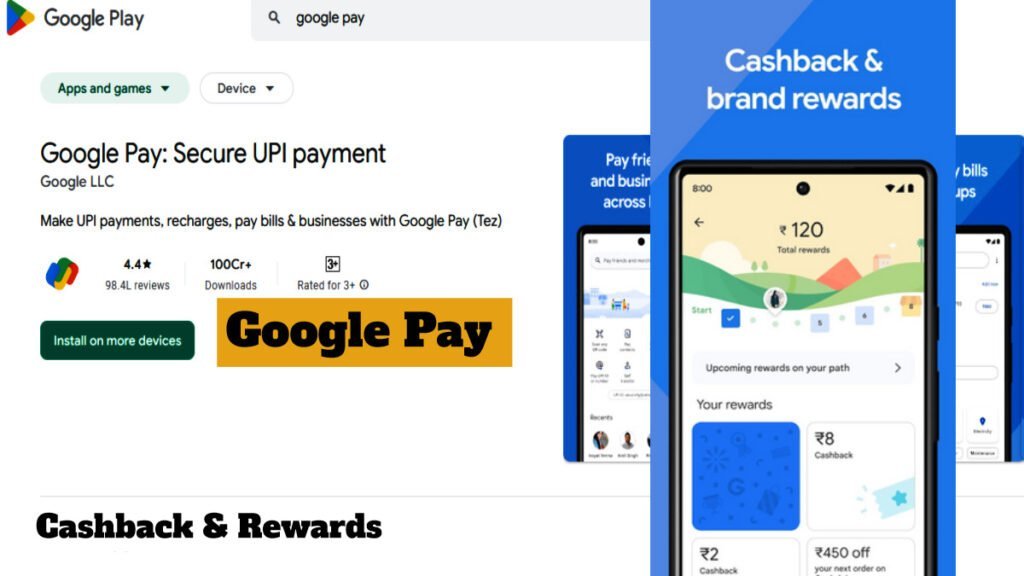

1. Google Pay

Google Pay is a UPI app that offers a variety of cashback and rewards programs. You can get cashback on everything from bill payments to online shopping to movie tickets. Google Pay also has a loyalty program called Google Pay Rewards, where you can earn points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Cashback and rewards programs offered by Google Pay

- Cashback on bill payments: You can get cashback on all types of bill payments, such as electricity bills, gas bills, and water bills.

- Cashback on online shopping: You can get cashback on online shopping at popular retailers such as Amazon, Flipkart, and Myntra.

- Cashback on movie tickets: You can get cashback on movie tickets booked through Google Pay.

- Google Pay Rewards: You can earn Google Pay Rewards points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Other benefits of using Google Pay

- Fast and secure payments: Google Pay uses UPI technology to make fast and secure payments.

- Easy to use: Google Pay is very easy to use. Simply link your bank account to Google Pay and start making payments.

- Wide acceptance: Google Pay is accepted by millions of merchants across India.

How to activate the Google Pay Cashback and Rewards Program

- Go to the Google Pay app and tap on the “Rewards” tab.

- Tap on the “Activate” button to activate the program.

- Once the program is activated, you will start earning cashback and rewards points on all eligible transactions.

How to redeem Google Pay Rewards points

- Go to the Google Pay app and tap on the “Rewards” tab.

- Tap on the “Redeem” button to redeem your rewards points for cashback or discounts.

- You can also use your Google Pay Rewards points to make purchases on Google Play and other partner merchants.

Google Pay is a great UPI app for people who want to earn cashback and rewards on their everyday purchases. The app is also very easy to use and is accepted by millions of merchants across India.

Download Google Pay [ Android ]

Download Goole Pay [ For IOS ]

Also, Read Best UPI Apps For Teenagers to manage their pocket money

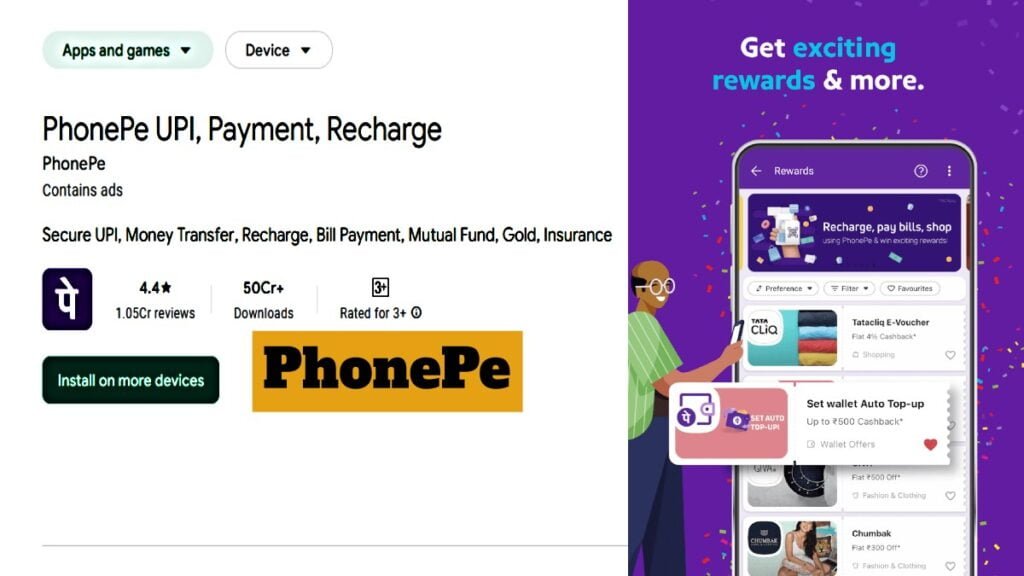

2. PhonePe

PhonePe is one of the most popular UPI apps in India, and it offers a variety of cashback and rewards programs. You can get cashback on everything from bill payments to online shopping to mobile recharges. PhonePe also has a loyalty program called PhonePe SuperCash, where you can earn rewards points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Cashback and rewards programs offered by PhonePe

- Cashback on bill payments: You can get cashback on all types of bill payments, such as electricity bills, gas bills, and water bills.

- Cashback on online shopping: You can get cashback on online shopping at popular retailers such as Amazon, Flipkart, and Myntra.

- Cashback on mobile recharges: You can get cashback on mobile recharges for all major telecom operators in India.

- PhonePe SuperCash: You can earn PhonePe SuperCash points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Other benefits of using PhonePe

- Fast and secure payments: PhonePe uses UPI technology to make fast and secure payments.

- Easy to use: PhonePe is very easy to use. Simply link your bank account to PhonePe and start making payments.

- Wide acceptance: PhonePe is accepted by millions of merchants across India.

How to activate the PhonePe Cashback and Rewards Program

- Go to the PhonePe app and tap on the “My Cashback” section.

- Tap on the “Activate Now” button to activate the program.

- Once the program is activated, you will start earning cashback and rewards points on all eligible transactions.

How to redeem PhonePe SuperCash

- Go to the PhonePe app and tap on the “My Cashback” section.

- Tap on the “Redeem Now” button to redeem your PhonePe SuperCash points for cashback or discounts.

- You can also use your PhonePe SuperCash points to make purchases on PhonePe Switch merchants.

PhonePe is a convenient and rewarding way to make payments for everyday goods and services. It is also a great way to save money on your purchases.

Also, Read Best UPI Apps For Businesses in 2023

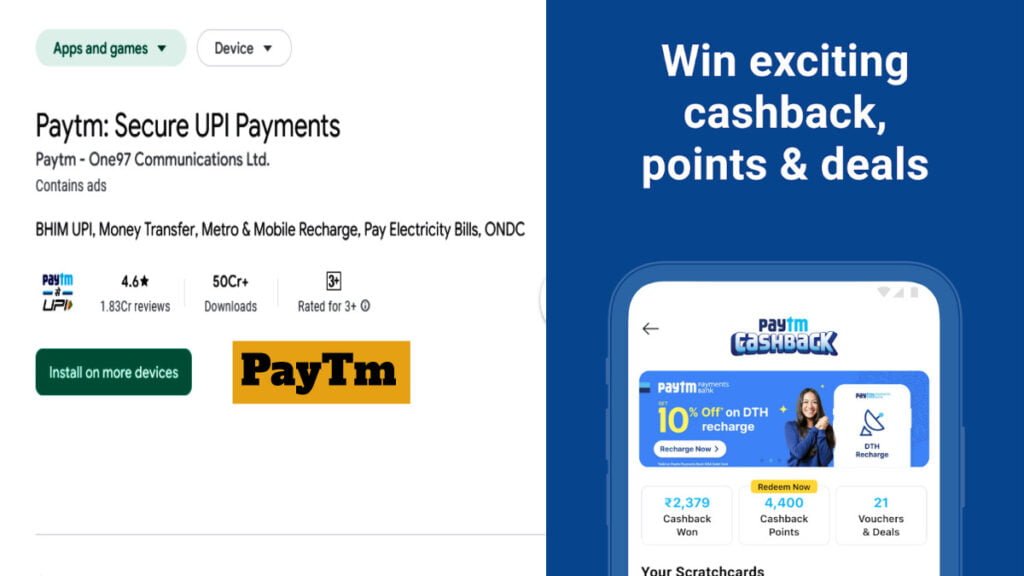

3. Paytm

Paytm is one of the oldest UPI apps in India, and it still offers a variety of cashback and rewards programs. You can get cashback on everything from bill payments to online shopping to mobile recharges. Paytm also has a loyalty program called Paytm Cashback, where you can earn cashback for every transaction you make.

Cashback and rewards programs offered by Paytm

- Cashback on bill payments: You can get cashback on all types of bill payments, such as electricity bills, gas bills, and water bills.

- Cashback on online shopping: You can get cashback on online shopping at popular retailers such as Amazon, Flipkart, and Myntra.

- Cashback on mobile recharges: You can get cashback on mobile recharges for all major telecom operators in India.

- Paytm Cashback: You can earn Paytm Cashback points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Other benefits of using Paytm

- Fast and secure payments: Paytm uses UPI technology to make fast and secure payments.

- Easy to use: Paytm is very easy to use. Simply link your bank account to Paytm and start making payments.

- Wide acceptance: Paytm is accepted by millions of merchants across India.

How to activate the Paytm Cashback and Rewards Program

- Go to the Paytm app and tap on the “Cashback & Offers” section.

- Tap on the “Activate Now” button to activate the program.

- Once the program is activated, you will start earning cashback and rewards points on all eligible transactions.

How to redeem Paytm Cashback point

- Go to the Paytm app and tap on the “Cashback & Offers” section.

- Tap on the “My Cashback” tab.

- Tap on the “Redeem Now” button to redeem your Paytm Cashback points for cashback, discounts, and other rewards.

- You can also use your Paytm Cashback points to make purchases on Paytm Mall and other partner merchants.

Overall Paytm is a popular & widely used UPI app in India that allows users to make payments for goods and services using their smartphones. It is also a great way to earn cashback and rewards on everyday purchases.

Also, Explore the top UPI apps for everyday transactions in 2023

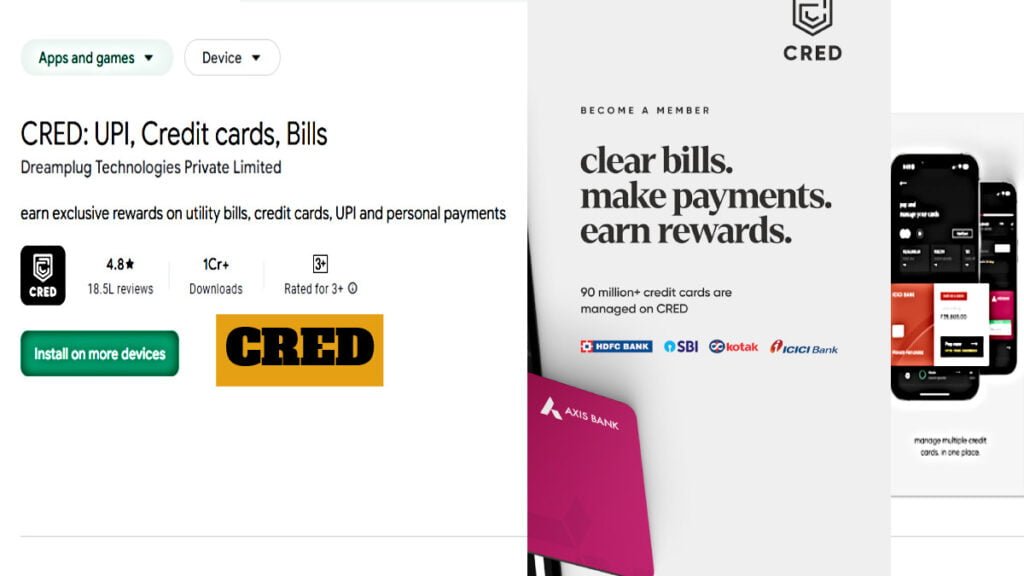

4. CRED

CRED is a relatively new UPI app, but it has quickly become one of the most popular. CRED is known for its generous cashback and rewards programs. You can get cashback on everything from bill payments to online shopping to food orders. CRED also has a loyalty program called CRED Coins, where you can earn coins for every transaction you make. These coins can be redeemed for cashback, discounts, and other rewards.

Cashback and rewards programs offered by CRED

- Cashback on credit card bill payments: You can get cashback on your credit card bill payments, up to 50% of your bill amount.

- Cashback on merchant payments: You can get cashback on your payments to select merchants, such as restaurants, bars, and hotels.

- Cashback on travel bookings: You can get cashback on your travel bookings, such as flights, hotels, and cabs.

- CRED coins: You can earn CRED coins for every eligible transaction you make. These coins can then be redeemed for cashback, discounts, and other rewards.

Other benefits of using CRED

- Early access to credit card offers: CRED members get early access to exclusive credit card offers and rewards.

- Personalized credit score insights: CRED members can get personalized insights into their credit score and how to improve it.

- Financial planning tools: CRED offers a variety of financial planning tools, such as budgeting and expense tracking.

How to activate the CRED Cashback and Rewards Program

- Download the CRED app and create an account.

- Link your credit card to CRED.

- Start making payments using CRED to earn CRED coins.

How to redeem CRED coins

- Go to the CRED app and tap on the “Coins” tab.

- Tap on the “Redeem” button.

- Select the cashback, discount, or other reward you want to redeem your coins for.

CRED is a great UPI app for people who want to earn cashback and rewards on their credit card bill payments and other eligible transactions. The app also offers a variety of other benefits, such as early access to credit card offers, personalized credit score insights, and financial planning tools.

5. Amazon Pay

Amazon Pay is a UPI app that offers a variety of cashback and rewards programs. You can get cashback on everything from bill payments to online shopping to mobile recharges. Amazon Pay also has a loyalty program called Amazon Pay Balance, where you can earn rewards points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Cashback and rewards programs offered by Amazon Pay

- Cashback on bill payments: You can get cashback on all types of bill payments, such as electricity bills, gas bills, and water bills.

- Cashback on online shopping: You can get cashback on online shopping on Amazon. in and other partner merchants.

- Cashback on mobile recharges: You can get cashback on mobile recharges for all major telecom operators in India.

- Amazon Pay Balance: You can earn Amazon Pay Balance points for every transaction you make. These points can be redeemed for cashback, discounts, and other rewards.

Other benefits of using Amazon Pay

- Fast and secure payments: Amazon Pay uses UPI technology to make fast and secure payments.

- Easy to use: Amazon Pay is very easy to use. Simply link your bank account to Amazon Pay and start making payments.

- Wide acceptance: Amazon Pay is accepted by millions of merchants across India.

How to activate the Amazon Pay Cashback and Rewards Program

- Go to the Amazon Pay app and tap on the “Cashback and Rewards” section.

- Tap on the “Activate” button to activate the program.

- Once the program is activated, you will start earning cashback and rewards points on all eligible transactions.

How to redeem Amazon Pay Balance

- Go to the Amazon Pay app and tap on the “Amazon Pay Balance” section.

- Tap on the “Redeem” button to redeem your rewards points for cashback or discounts.

- You can also use your Amazon Pay Balance to make purchases on Amazon.in and other partner merchants.

When choosing a Best UPI app for cashback, consider the following factors

- The types of cashback and rewards programs offered: Some UPI apps offer cashback on specific types of transactions, such as bill payments or online shopping. Others offer cashback on all types of transactions.

- The amount of cashback and rewards offered: Some UPI apps offer higher cashback and rewards than others.

- The terms and conditions of the cashback and rewards programs: Some cashback and rewards programs have restrictions on how and when they can be redeemed.

Tips for optimizing your cashback and rewards earnings

- Use the right UPI app for different types of transactions: If you are making a bill payment, use a UPI app that offers cashback on bill payments. If you are shopping online, use a UPI app that offers cashback on online shopping.

- Take advantage of limited-time offers: UPI apps often offer limited-time cashback and rewards offers. Keep an eye out for these offers and take advantage of them to maximize your earnings.

- Refer your friends and family: Some UPI apps offer referral bonuses. When you refer your friends and family to the app, you can earn cashback or other rewards for each person who signs up and makes a transaction.

FAQs – Best UPI Apps for Cashback and Rewards

1. What are UPI apps?

UPI apps are mobile applications that allow you to make payments using the Unified Payments Interface (UPI). UPI is a real-time payment system that facilitates fast and secure inter-bank transactions between individuals and businesses.

2. What are the benefits of using UPI apps?

- Fast and secure payments: UPI uses secure technology to make instant payments.

- Convenient: You can make payments anytime, anywhere using your smartphone.

- Cashless transactions: You don’t need to carry cash to make payments.

- Cashback and rewards: Many UPI apps offer cashback and rewards programs that can help you save money on your everyday purchases.

3. What are the best UPI apps for cashback and rewards?

- Google Pay

- PhonePe

- Paytm

- CRED

- Amazon Pay

4. How do I choose the best UPI app for cashback and rewards?

- The types of cashback and rewards programs offered: Some apps offer cashback on specific transactions, while others offer it on all transactions.

- The amount of cashback and rewards offered: Different apps offer varying cashback and reward percentages.

- The terms and conditions of the programs: Some programs may have restrictions on how and when you can redeem your rewards.

5. How can I optimize my cashback and rewards earnings?

- Use the right app for different transactions: Choose a UPI app that offers the highest cashback for the specific transaction type (bill payment, online shopping, etc.).

- Look for limited-time offers: Many UPI apps offer special cashback and reward promotions. Keep an eye out for these to boost your earnings.

- Refer friends and family: Some apps offer referral bonuses when you refer new users who sign up and make transactions.

6. Is it safe to use UPI apps for transactions?

UPI uses secure technology to encrypt your financial information and protect your transactions. However, it’s important to practice safe habits like using strong passwords and being cautious about clicking on suspicious links.

1 Response

[…] Movie Ticket Booking – Book Your Ticket Now ( Cashback UPI Apps To Book Movie […]