Best Zero Brokerage Trading Apps [2025]

Investing in the stock market no longer means paying hefty brokerage fees. With Top 4 zero brokerage trading apps in India, you can trade stocks, mutual funds, and other assets without commission charges—helping you maximize your returns.

But with so many options available, how do you choose the best platform? In this article, we’ll compare the best zero brokerage trading apps in India [2025], highlighting their features, benefits, and why they stand out.

Why Choose a Zero Brokerage Trading App?

✅ Save More: No brokerage fees mean higher profits.

✅ Beginner-Friendly: Simple interfaces with easy-to-use tools.

✅ Advanced Features: AI-driven insights, live market data, and portfolio tracking.

✅ Fast & Secure: Lightning-fast trade execution with top-notch security.

Whether you’re a seasoned investor or just starting your trading journey, these zero brokerage platforms can help you trade smarter and save more. Keep reading as we unveil the top trading apps in India for 2025

Tabale of Content

Get Kotak Neo A Legacy Brand with Zero Brokerage (if your age is under 30)

Get mStock for Lifetime Zero Brokerage (For All)

Key Considerations

Before diving into specific apps, let’s understand the crucial factors to consider:

- Investment Instruments: What assets do you want to trade? Stocks, options, mutual funds, ETFs, IPOs? (Include relevant keywords)

- Trading Features: Do you need advanced charting tools, technical indicators, margin trading, or stop-loss orders? (Mention specific features offered by top apps)

- Hidden Costs: Beyond “zero brokerage,” are there account maintenance fees, inactivity fees, stamp duty, or transaction charges? (Emphasize transparency)

- User Experience: Is the platform mobile-friendly, intuitive, and easy to navigate? Does it offer educational resources? (Highlight user-friendliness and learning support)

- Customer Support: 24/7 availability, multiple communication channels, and quick response times are crucial. (Stress the importance of reliable support)

Top Contenders

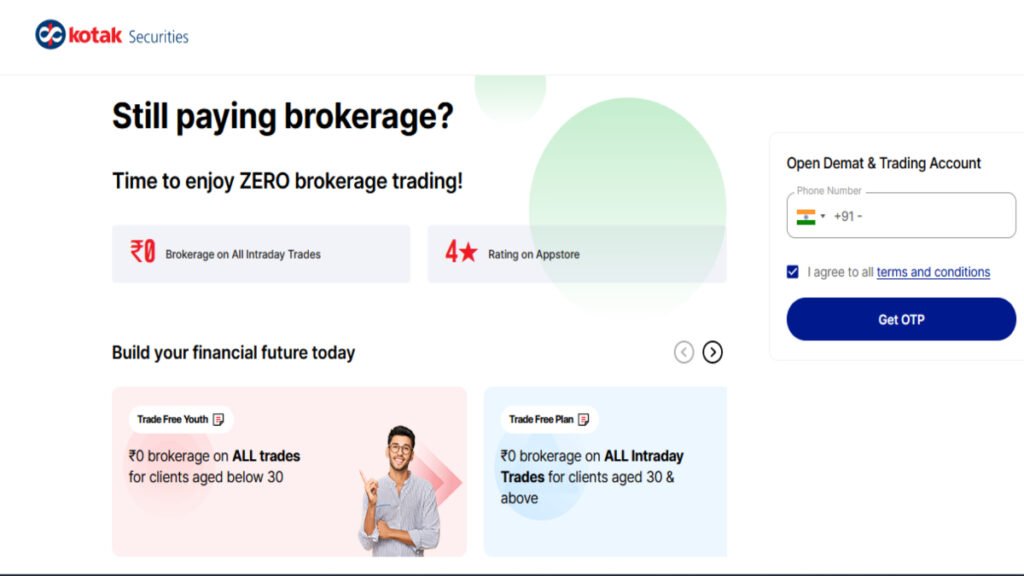

1. Kotak Neo: A Legacy Brand With Zero Brokerage Trading App

Kotak Neo, launched in 2020, is a mobile-first trading app from Kotak Securities, a well-established and trusted name in the Indian financial landscape. While it arrived later than some competitors, it aims to capitalize on Kotak’s legacy and offer a competitive zero brokerage experience. Let’s delve into its key features and see if it lives up to the hype.

Key Features

- Zero brokerage for equity delivery trades, intraday trades, and F&O trades.

- Modern mobile app with intuitive design and features.

- Advanced charting tools with technical indicators and drawing tools.

- Margin trading facility for intraday

- IPO investment facility.

- Mutual fund investment platform.

- Direct mutual fund investments without additional charges.

- News and research integration from Kotak Securities.

- 24/7 customer support.

Strengths

- Legacy and trust: Backed by Kotak Securities, Kotak Neo benefits from a strong brand reputation and established financial expertise.

- Direct mutual fund investments: This eliminates platform fees for mutual fund investments, offering potential cost savings.

- News and research integration: Access to Kotak Securities’ research resources can be valuable for informed trading decisions.

- Seamless integration with Kotak accounts: If you already have a Kotak account, transitioning to Neo is smooth and convenient.

Weaknesses

- Relatively new: Compared to established players like Zerodha or Upstox, Kotak Neo is still establishing its track record.

- Limited educational resources: While some resources are available, they might not be as comprehensive as some competitors.

- Hidden fees: While brokerage is zero, account maintenance fees and other charges might apply. Careful review is necessary.

Suitability

- Investors seeking a trusted brand: Those who value the legacy and experience of Kotak Securities might find comfort in Neo.

- Mutual fund investors: The direct investment option can be cost-effective for frequent mutual fund investors.

- Existing Kotak customers: Users with existing Kotak accounts can enjoy a seamless transition and integrated experience.

Kotak Neo offers a promising zero brokerage ( First 2 Year For People Who has Age Less Than 30 Year ) platform backed by a reputable brand. While it’s still establishing its presence, its direct mutual fund investment option, Kotak-specific resources, and mobile-first approach are attractive features. However, limited educational resources and potential hidden fees require careful consideration.

Also Read Best UPI App for Cashback on Bills & Payments

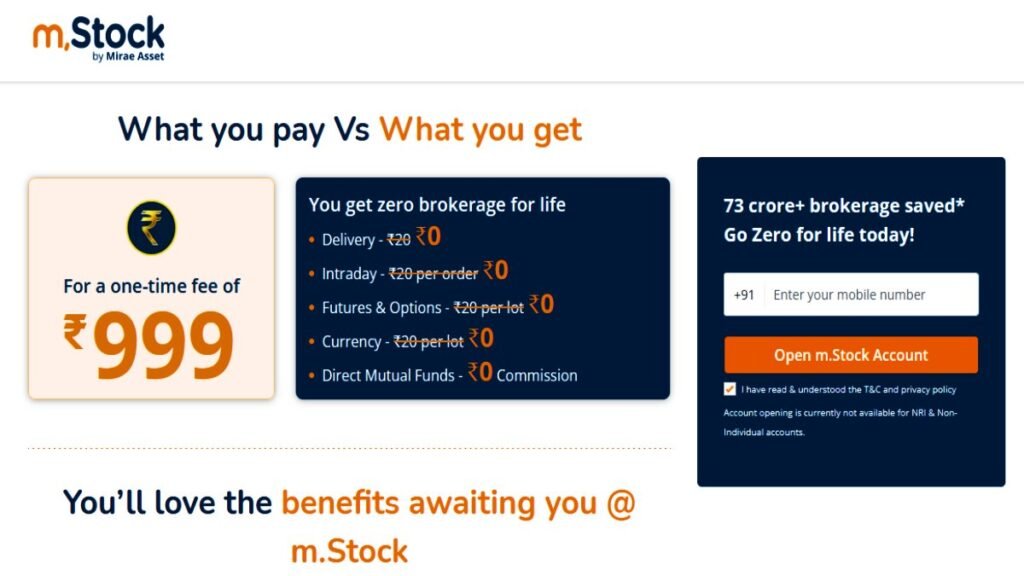

2. mStock: True Zero Brokerage Trading App [Life Time]

mStock, a subsidiary of Mirae Asset Capital, boasts a unique proposition in the Indian zero brokerage landscape: truly zero brokerage across all segments and order types. This translates to no hidden fees or charges for equity, derivatives, currencies, commodities, or IPOs, making it an attractive option for value-conscious investors. Let’s delve deeper into mStock’s features and assess its suitability for different investor profiles.

Key Features

- True zero brokerage: No charges for any trades, including delivery, intraday, options, currencies, commodities, and IPOs.

- Fundamental research: Access to fundamental research reports and company analysis.

- Educational resources: Tutorials, webinars, and articles to help investors learn and make informed decisions.

- Margin trading facility: Leverage your holdings for intraday

- Advanced charting tools: Technical indicators and drawing tools for market analysis.

- IPO investment facility: Apply for IPOs directly through the platform.

- 24/7 customer support: Available through phone, email, and live chat.

Strengths

- Truly zero brokerage: This sets mStock apart from competitors who might have hidden fees or charges for specific segments.

- Fundamental research: Valuable for investors who prefer fundamental analysis over technical indicators.

- Educational resources: Helpful for beginners and those seeking to improve their investment knowledge.

- Margin trading facility: Offers flexibility for intraday and options trading strategies.

Weaknesses

- Less user-friendly interface: Compared to some competitors, the interface might require a slight learning curve.

- Limited advanced charting tools: The platform might not cater to highly technical traders seeking sophisticated charting features.

- Limited research compared to some competitors: While fundamental research is available, it might not be as comprehensive as some other platforms.

Suitability

mStock is a good fit for:

- Value-conscious investors: Those prioritizing zero brokerage and minimizing trading costs.

- Fundamental investors: Users who rely on fundamental analysis for investment decisions.

- Beginners and learning investors: The educational resources can be valuable for building knowledge.

- Passive investors: Those primarily focusing on long-term investments and delivery trades.

Overall

mStock offers a compelling proposition with its true zero brokerage across all segments. The fundamental research and educational resources add value, particularly for beginners and value-oriented investors. However, the interface might require some learning, and advanced charting tools might be limited for highly technical traders. Carefully consider your needs and compare mStock with other platforms before making a decision.

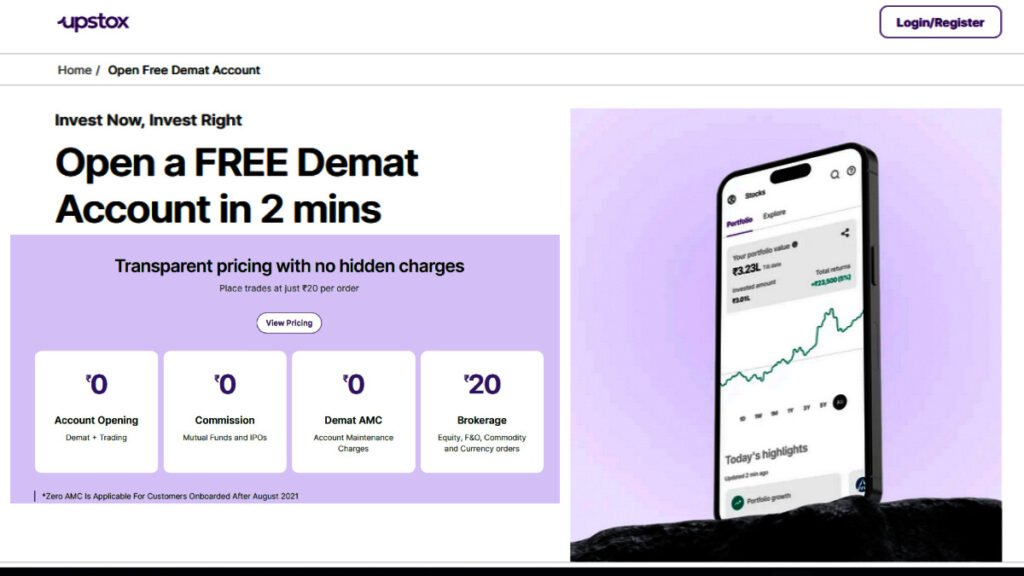

3. Upstox: No Hidden Charges Trading App

Upstox, formerly known as RKSV Securities, is a prominent discount broker in India known for its sleek mobile-first approach and zero brokerage offerings for equity mutaul funds . Launched in 2012, it has garnered a loyal user base, particularly among young investors, thanks to its user-friendly interface and focus on mobile trading.

Key Features

- Zero brokerage for equity delivery trades, intraday trades, F&O trades [20 Per Order]

- Mobile-first platform with intuitive design and features.

- Advanced charting tools with technical indicators and drawing tools.

- Margin trading facility for intraday

- IPO investment facility.

- Mutual fund investment platform.

- Educational resources and webinars for beginners.

- 24/7 customer support.

Strengths

- User-friendly interface: Upstox boasts a clean and simple interface that is easy to navigate, even for first-time investors.

- Mobile-first approach: The mobile app is feature-rich and offers a seamless trading experience.

- Zero brokerage: Upstox’s zero brokerage structure makes it an attractive option for cost-conscious investors.

- Wide range of investment products: Upstox offers a variety of investment options, including equities, options, futures, mutual funds, and IPOs.

- Educational resources: Upstox provides educational resources and webinars to help investors learn about the stock market.

Weaknesses

- Limited research: Compared to some competitors, Upstox’s research offerings are somewhat limited.

- Customer support: While available 24/7, customer support response times might vary depending on peak hours.

- No advanced order types: Upstox’s order types are limited to basic options like market orders, limit orders, and stop orders.

Suitability

Upstox is a suitable option for:

- Beginner investors: The user-friendly interface and educational resources make it easy for new investors to get started.

- Mobile-first investors: Those who primarily trade on their mobile phones will appreciate the app’s features and functionality.

- Cost-conscious investors: Upstox’s zero brokerage structure makes it an attractive option for those looking to minimize trading costs.

Overall

Upstox is a solid zero brokerage trading app with a user-friendly interface, mobile-first approach, and a wide range of investment products. While its research offerings and customer support could be improved, it remains a popular choice for many Indian investors, especially beginners and those who prioritize mobile trading.

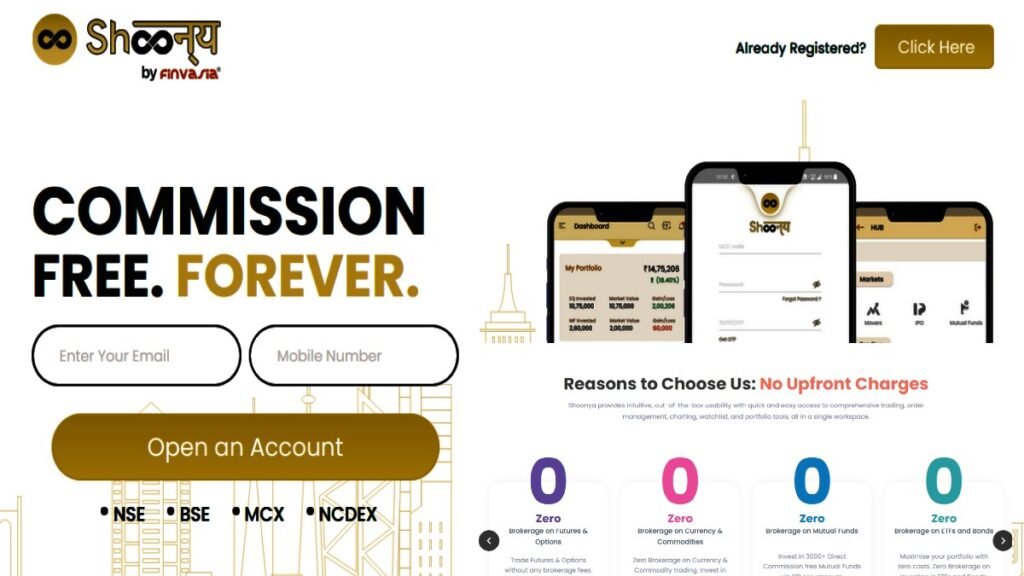

4. Shoonya by Finvasia: A Real Zero Brokerage Trading App Platform

Shoonya, launched in 2016 by Finvasia, is a discount broker that offers zero brokerage on all equity delivery and intraday trades, as well as F&O trades. It is a popular choice among Indian investors for its low-cost trading and user-friendly platform.

Key Features

- Zero brokerage: No charges for equity delivery, intraday, and F&O trades.

- Advanced charting tools: Technical indicators and drawing tools for market analysis.

- Margin trading facility: Leverage your holdings for intraday and F&O trades.

- Option chain analysis: Analyze options contracts and identify potential trading opportunities.

- Multi-exchange trading: Trade on NSE, BSE, MCX, and NCDEX.

- Basket orders: Place multiple orders simultaneously for better trade execution.

- IPO investment facility: Apply for IPOs directly through the platform.

- 24/7 customer support: Available through phone, email, and live chat.

Strengths

- Zero brokerage: This sets Shoonya apart from competitors who might have hidden fees or charges for specific segments.

- Advanced charting tools: Valuable for technical traders who rely on technical indicators for market analysis.

- Margin trading facility: Offers flexibility for intraday and options trading strategies.

- Multi-exchange trading: Provides access to multiple exchanges, increasing trading opportunities.

Weaknesses

- Limited research: Compared to some competitors, the research offerings might not be as comprehensive.

- Customer support: While available 24/7, response times might vary depending on peak hours.

- No account opening charges: While trading is zero brokerage, there might be account opening and maintenance charges.

Suitability

Shoonya is a good fit for

- Value-conscious investors: Those prioritizing zero brokerage and minimizing trading costs.

- Technical traders: Users who rely on technical analysis for investment decisions.

- Active traders: Those who trade frequently and require advanced features like margin trading and multi-exchange trading.

Overall

Shoonya offers a compelling proposition with its zero brokerage across all segments and advanced charting tools. The margin trading facility and multi-exchange trading add value, particularly for active traders. However, the research offerings could be improved, and customer support response times might vary. Carefully consider your needs and compare Shoonya with other platforms before making a decision.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Beyond the Big Names

Explore Fyers (advanced traders), Nuvama Wealth (wealth management focus), and Alice Blue (research-oriented). Include specific keywords highlighting their unique features.

Conclusion

By understanding your needs and utilizing this guide, you can navigate the world of zero brokerage apps and choose the one that empowers your financial journey. Remember, this is just a starting point, and continuous research is key.