Hindenburg Research India: What Next after Adani Controversy

Hindenburg Research India : Stirring the Indian Market

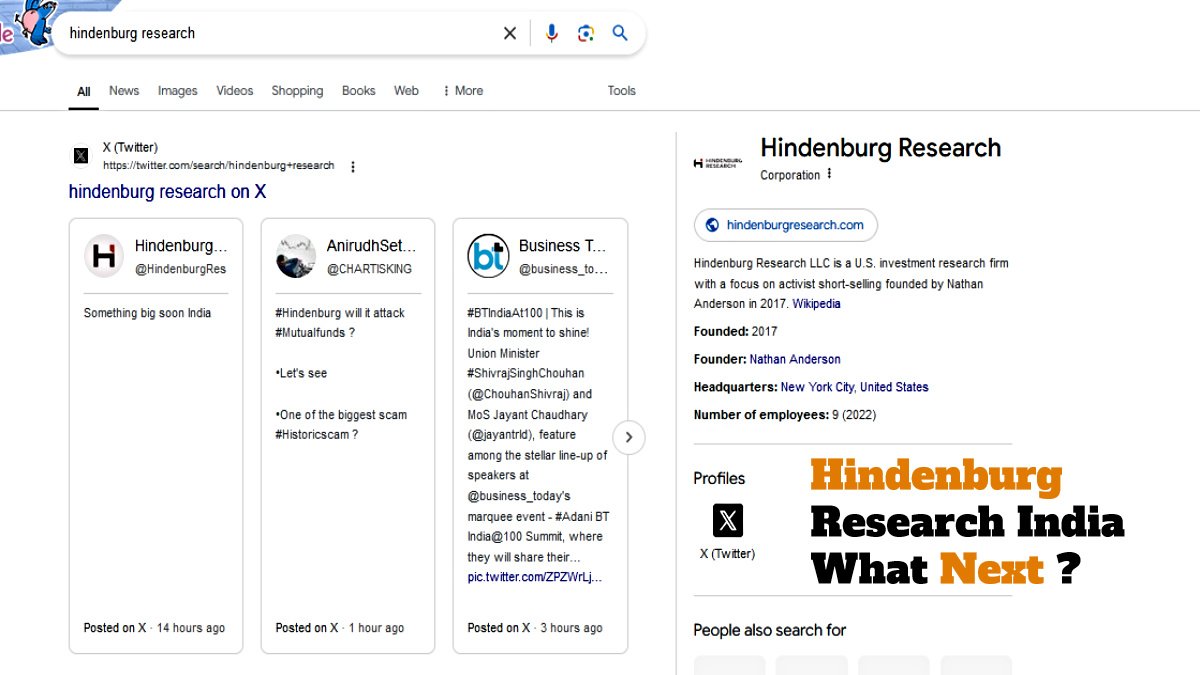

Hindenburg Research, a U.S.-based forensic financial research firm, has made headlines in India with its sensational report on the Adani Group. Known for its deep dives into corporate malpractices, the firm has ignited a storm of scrutiny and debate within India’s financial circles.

The Adani Controversy: A Turning Point

In January 2023, Hindenburg Research dropped a bombshell report accusing the Adani Group of stock manipulation, accounting fraud, and various financial irregularities. This report not only sent shockwaves through the Indian stock market but also led to a dramatic erosion of the Adani Group’s market value, wiping out billions of dollars in investor wealth almost overnight.

The repercussions of this report have been profound. It has triggered a wave of scrutiny regarding corporate governance in India and raised serious questions about the effectiveness of the regulatory environment. In response, both the Indian government and regulatory bodies such as SEBI (Securities and Exchange Board of India) launched investigations into the allegations, while the Adani Group strongly denied any wrongdoing.

Hindenburg’s Broader Agenda in India

While the Adani Group remains the most prominent subject of Hindenburg’s investigations in India, the firm has hinted at more revelations to come. A cryptic social media post stating “Something big soon India” has left the Indian corporate world on edge, suggesting that other major companies might also come under the microscope.

This indicates that Hindenburg is likely expanding its focus in India, potentially targeting other firms suspected of corporate misconduct. If so, this could usher in a new era of rigorous scrutiny of corporate governance and financial transparency across the Indian market.

Hindenburg Research India Impact on Financial Landscape

The fallout from the Hindenburg report has been significant, leading to increased investor caution and a surge in regulatory scrutiny. The report has sparked a renewed emphasis on corporate governance, as companies and regulators alike strive to rebuild trust and stability in the market.

Moreover, the controversy has cast a spotlight on India’s standing as a global investment destination. The government now faces the challenge of restoring investor confidence, which will require not just damage control but also substantial reforms to bolster the regulatory framework.

Conclusion

Hindenburg Research has positioned itself as a formidable force in India’s corporate world. Its focus on uncovering corporate malfeasance has exposed critical issues in corporate governance and regulatory oversight. While the Adani Group case is the most prominent, it may be just the beginning. As Hindenburg continues to probe deeper into the practices of Indian companies, both businesses and investors will need to stay alert and prepared for potential upheavals.