Nifty Next 50 F&O Launch: Tapping High-Growth With Derivatives

The National Stock Exchange of India (NSE) is gearing up to introduce a revolutionary product for active traders: Nifty Next 50 F&O (Futures & Options). Launching on April 24, 2024, this move promises to shake up the derivatives market and provide an exciting new avenue to capitalize on India’s booming stock market. But what exactly is Nifty Next 50 F&O, and how can it benefit traders?

Discover Best Zero Brokerage Trading Apps that help to grow small capital

Introduction-Nifty Next 50 F&O

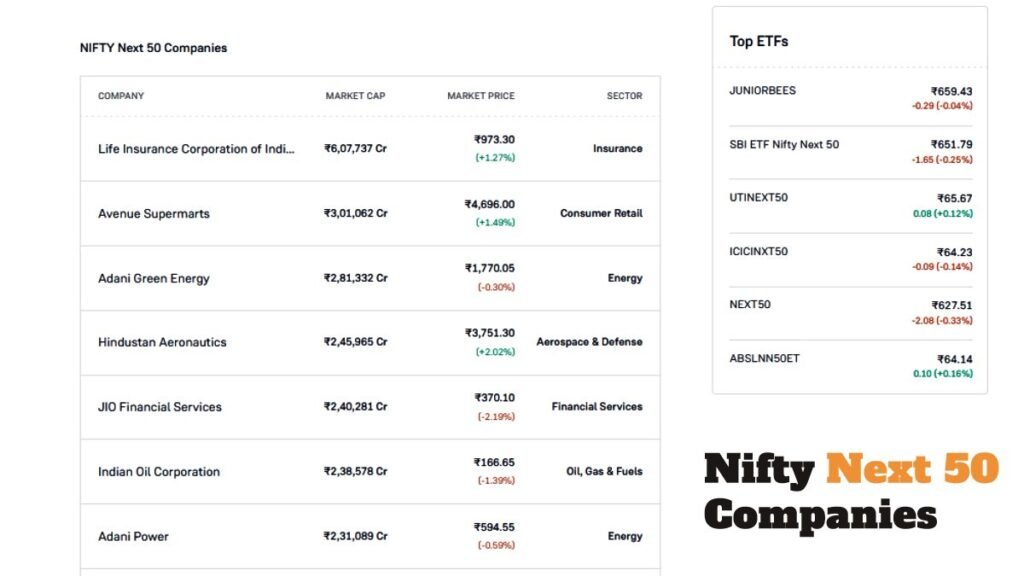

The Nifty Next 50 index tracks the performance of the next 50 companies in line to potentially enter the prestigious Nifty 50 index. These companies represent the future of the Indian market, brimming with high-growth potential. Nifty Next 50 F&O refers to financial contracts based on this index, offering two main instruments:

- Nifty Next 50 Futures: These contracts allow traders to speculate on the future price movement of the Nifty Next 50 index. If you believe the index will rise, you can buy futures contracts, and if you anticipate a fall, you can sell them.

- Nifty Next 50 Options: Options contracts provide the right, but not the obligation, to buy or sell the Nifty Next 50 index at a predetermined price by a specific expiry date. This offers flexibility and the potential for magnified returns, but also carries greater risk.

Potential-Nifty Next 50 F&O

The introduction of Nifty Next 50 F&O presents several compelling advantages for active traders:

- High-Growth Exposure: By participating in Nifty Next 50 F&O, traders gain access to the high-growth potential of companies on the verge of joining the Nifty 50. This allows them to capitalize on India’s promising economic future.

- Sophisticated Hedging Strategies: Existing investors in Nifty Next 50 companies can utilize F&O instruments to hedge their portfolios against potential losses. This helps manage risk and protect their investments.

- Enhanced Market Liquidity: The introduction of F&O is expected to significantly increase liquidity in Nifty Next 50 stocks. This translates to smoother entry and exit points for traders, facilitating their investment strategies.

Nifty Next 50 Index Futures and Options: A Detailed Breakdown

The National Stock Exchange of India (NSE) is set to launch derivative contracts based on the Nifty Next 50 index, starting April 24, 2024. This guide provides a comprehensive explanation of both Nifty Next 50 Futures and Options contracts.

Nifty Next 50 Futures Contracts

Futures contracts are agreements to buy or sell a specific value of the Nifty Next 50 index at a predetermined price on a future date (expiry date).

Contract Specifications

| Feature | Description |

|---|---|

| Security Descriptor | Market Type: N Instrument Type: FUTIDX Symbol: NIFTYNXT50 Underlying: Nifty Next 50 Index Expiry Date: Date of contract expiry |

| Underlying Instrument | Nifty Next 50 Index |

| Trading Cycle | Three consecutive months (Near-month, Mid-month, Far-month). New contracts are introduced after the expiry of the near-month contract. |

| Expiry Day | Last Friday of the expiry month (unless a trading holiday). |

| Trading Parameters | * Contract Size: Minimum value of Rs. 5 lakhs at introduction (subject to change by NSE). Lot size will be the same for both futures and options contracts for a given underlying index. |

Nifty Next 50 Index Options Contracts

What are they?

Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) the Nifty Next 50 index at a certain price (strike price) by a specific expiry date.

Contract Specifications:

| Feature | Description |

|---|---|

| Security Descriptor | Same as Nifty Next 50 Futures Contracts |

| Underlying Instrument | Nifty Next 50 Index |

| Trading Cycle | Three consecutive months (Near-month, Mid-month, Far-month). New contracts are introduced after the expiry of the near-month contract. |

| Expiry Day | Last Friday of the expiry month (unless a trading holiday). |

| Strike Price Intervals | Based on the previous day’s closing value of the underlying index (refer to source for details). |

| Trading Parameters | * Contract Size: Minimum value of Rs. 5 lakhs at introduction (subject to change by NSE). Lot size will be the same for both futures and options contracts for a given underlying index. |

Additional Resources:

Considerations

While Nifty Next 50 F&O offers exciting prospects, there are crucial factors to consider before diving in:

- Limited Track Record: Compared to the well-established Nifty 50, the Nifty Next 50 boasts a shorter history. This translates to less historical data for analysis, potentially leading to higher market volatility.

- Dynamic Index Composition: The companies within the Nifty Next 50 index are subject to change as new companies enter and existing ones move out. Staying informed about the index’s composition is vital for making sound trading decisions.

The launch of Nifty Next 50 F&O marks a significant development in the Indian stock market. It presents a unique opportunity for active traders to tap into the high-growth potential of promising young companies. However, careful consideration of the inherent volatility and a thorough understanding of the underlying index are essential for navigating this exciting new market avenue. Remember, with great reward comes calculated risk – do your research before venturing into Nifty Next 50 F&O.

Risk Factors

The information provided in this article regarding Nifty Next 50 F&O (Futures & Options) is for informational purposes only and should not be considered financial advice. Trading F&O contracts involves substantial risk and the potential for significant financial loss. Carefully consider your investment objectives, risk tolerance, and financial situation before participating in any F&O transactions.