What is UPI Full Form and How Does it Work?

Table of Contents

UPI Full form

UPI stands for Unified Payments Interface It’s a quick and real-time payment system that allows you to instantly send money between two bank accounts using mobile apps.

UPI is an instant real-time payment system developed by the National Payments Corporation of India (NPCI) facilitating inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions. The interface is regulated by the Reserve Bank of India (RBI).

UPI uses a mobile phone to make real-time payments between two bank accounts on a single platform. It is a convenient and secure way to send and receive money, without the need for cash or cards.

How does UPI work?

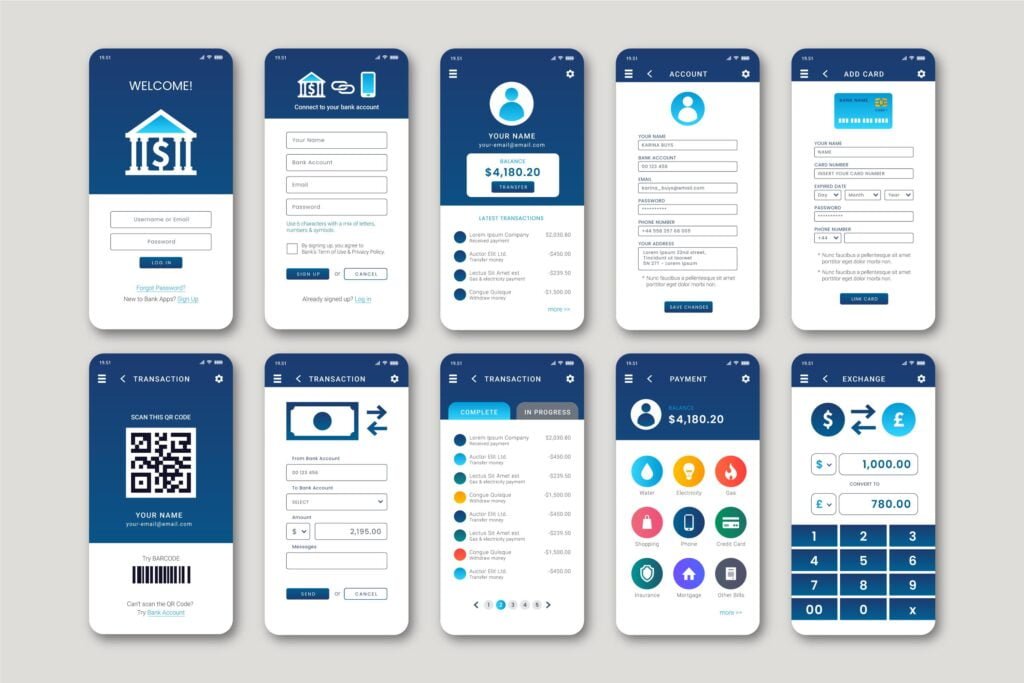

UPI works by creating a virtual payment address (VPA) for each bank account. This VPA can be used to send and receive money from other UPI users. To make a payment, simply enter the recipient’s VPA and the amount you want to send. UPI will then verify the recipient’s details and debit the amount from your account.

UPI payments can be made using a variety of methods, including:

- VPA: Enter the recipient’s VPA and the amount you want to send.

- Account number: Enter the recipient’s account number and IFSC code.

- Mobile number: Enter the recipient’s mobile number and UPI PIN.

- QR code: Scan the recipient’s QR code using your UPI app.

Benefits of using UPI

There are many benefits to using UPI, including:

- Convenience: UPI is a convenient way to send and receive money, without the need for cash or cards.

- Security: UPI payments are secure, as they are protected by two-factor authentication.

- Speed: UPI payments are processed instantly, so you can send and receive money quickly.

- Cost-effectiveness: UPI payments are free for most banks.

- Accessibility: UPI can be used by anyone with a mobile phone and a bank account.

How to use UPI

To use UPI, you will need a mobile phone with a UPI-enabled app. There are many UPI apps available, such as Google Pay, Paytm, and PhonePe.

What is UPI ID & how to create it

Once you have downloaded a UPI app, you will need to create an account and link your bank account. You can then start sending and receiving money using your VPA.

UPI in India

UPI has been a huge success in India, with over 500 million users. It has helped to drive the growth of digital payments in the country.

UPI is expected to continue to grow in popularity in India, as it is a convenient, secure, and cost-effective way to send and receive money.

Conclusion

UPI is a revolutionary payment system that has made it easier and more convenient for people to send and receive money in India. It is a secure and cost-effective way to make payments, and it is expected to continue to grow in popularity in the years to come.